What is ELSS?

Invest in Best Equity Linked Savings Scheme Funds &

Save Up to Rs 46,800 a Year in Taxes

Trusted By Over 40 lakh Indians

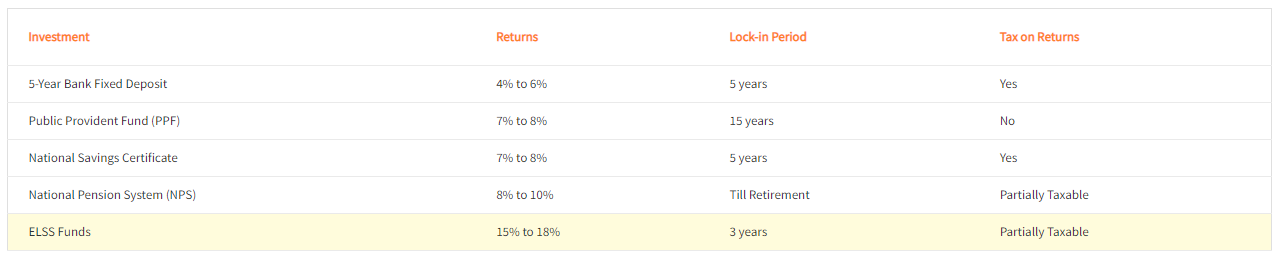

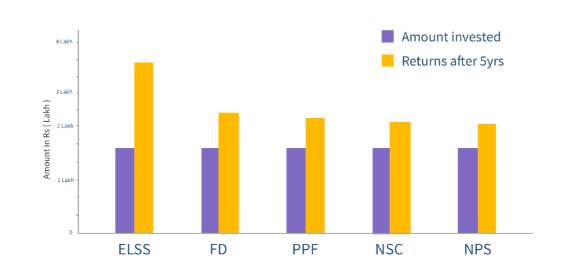

Investing in ELSS mutual funds comes with the dual benefit of tax deductions and wealth accumulation over time. ELSS mutual funds have a lock-in period of just three years, the shortest among all tax-saving investments and have the potential to offer the highest returns among 80C options.

The shortest lock-in period of

just 3 Years

2x returns of

FD/PPF

Option to invest a small amount

every month (SIP)

Invest as low as Rs 100

a month

An ELSS fund or an equity-linked savings scheme is the only kind of mutual funds eligible for tax deductions under the provisions of Section 80C of the Income Tax Act, 1961. You can claim a tax rebate of up to Rs 1,50,000 and save up to Rs 46,800 a year in taxes by investing in ELSS mutual funds.

ELSS mutual funds’ asset allocation is mostly (65% of the portfolio) made towards equity and equity-linked securities such as listed shares. They may have some exposure to fixed-income securities as well. These funds come with a lock-in period of just three years, the shortest among all Section 80C investments.

The following are the main features of ELSS mutual funds:

ELSS mutual funds provide tax deductions of up to Rs 1,50,000 a year under the provisions of Section 80C of the Income Tax Act, 1961. This helps you save up to Rs 46,800 a year in taxes. However, note that your investments are locked-in for three years from the date of investment.

You have to consider the following factors while choosing to invest in an ELSS mutual fund:

Investing via an SIP is advisable if you are not willing to take higher risk. When you invest through an SIP, you get the opportunity of investing in a fund across business cycles. This helps you get the benefit of purchasing the fund units across market cycles. When the markets are down, you buy more units while you purchase fewer units when the markets are bullish. Therefore, over time, your price of purchase of fund units gets averaged out and turns out to be on the lower side. You will benefit from this when the markets rise as you can realise higher capital gains on redemption. This benefit is not available if you invest a lump sum.

Investing a lump sum is not advisable unless the markets are gripped by a bearish trend, and you are willing to take higher risk levels and have a longer investment horizon. You miss out on the opportunity to purchase fund units across business cycles, which requires you to stay invested for longer than 5-7 years to realise good gains.